If you would like to deregister your business for SST you may do so by submitting an SST Deregistration requested to the Royal Malaysian Customs Department. Navigate to the Services Registration Application for Cancellation of Registration option.

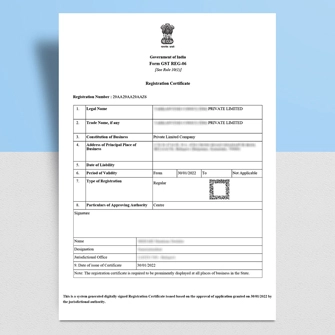

Everything About Gst Registration Of A Private Limited Company Ebizfiling

This can be done if you have been automatically registered for SST and your business does not generate any taxable services or is generating an income which is below the RM500000 threshold.

. Enter the reasons for revocation and attach the supporting documents. Enter the ARN Number. Steps To Cancel GST Online Registration On The GST Portal.

Form GST REG 16 should be used to file a cancellation request. A the business has been discontinued transferred fully for any reason including. By phone on 13 28 66 between 800am and 600pm Monday to Friday by completing the Application to cancel registration NAT 2955 through online ordering and posting it to us.

That other party needs to register under GST. At the time of registration cancellation inputs semi-finished goods and finished goods were held in stock. Check the status of your GST Registration application.

Business number BN legal name of the business cancellation date reason for closing the GSTHST account. You will be then directed to the GST dashboard where you have to select Services. The proper officer may cancel the registration either on his own motion or an application filed by the registered person or by his own legal heirs in case of death of such person as per the Rules having regard to the circumstances where.

In myIR go to your GST account Select More Select Cancel account registration Log in to myIR myIR login What happens next Well contact you if we need more information. The form - Application for Cancellation of Registration contains three tabs. If your business has been closed If the business has been sold or transferred to some other party.

What Does the Cancellation of GST Mean. Payment of tax is made in stages by the intermediaries in the production. If your turnover is not more than 20 lakh now Rs.

GST is also chargeable on the importation of goods and services into Malaysia. With the help of your username and correct password login into your account. Please click on the title to download the guide.

A thorough step-by-step procedure will guide you through the cancellation of your GST so read on. GST registration can be canceled by the registered person or by the GST officer or by the registered persons legal heirs in case of death Skentino. Visit the GST Portal.

Navigate to the GST Portal. When should you cancel your GST Registration. Click the Cancellation of Provisional Registration.

Most online applications for the cancellation of GST registration are approved on the day of application with exceptions of some that may take 1 to 10 working days to process. The person authorised to access myTax Portal to submit GST returns can log in to mytaxirasgovsg to apply for the cancellation of GST registration online. Following is the procedure to be followed by the officer in case he has a reason to cancel the GST registration of the taxpayer.

How Do You Cancel Your GST Registration. Go to the Dashboard and then select services. Open or manage an account Close 1.

A person can complete a GST REG form if possible to complete any tax invoice. All taxpayers who do not issue an invoice after registration can opt for this service. 1 Getting Ready for GST - Registering for GST 2 Registration revised as at 23 April 2014 3 GST Electronic Services Taxpayer Access Point TAP Handbook 4 Click Multimedia Video for Registration.

Malaysia except those specifically exempted. You will be asked if. The proper officer is required to raise a show cause notice in form GST REG-17.

Online services for agents allows registered tax agents to update or cancel a clients tax registration. In this regard liability is important and is to be mentioned. Steps to cancel GST migrant.

Navigate to the GST Portal. Enter the GSTIN Number. The taxpayer on receipt of the notice from the proper officer is required to file a suitable reply in form GST REG-18 within.

Close Information you need to close deregister your GSTHST account When you are ready to close deregister your GSTHST account you will need all the following information. This article goes through the specifics of canceling the GST registration which will help you in this situation. Follow the instructions below.

Follow the following steps for the ActivationRevocation of Cancelled GST Registration. Form GST REG 16 must include the following information. What Exactly is GST.

Ensure that the Basic Details tab is selected by default. Once the Cancellation Page opens it displays your GSTIN and Business name. Go to the official GST Portal at wwwgstgovin Step 2.

Effective date for GST registration is 1 July 2016 first day of the following month after the end of the twenty-eight day liability since. You may check the progress of a GST Registration application by following the procedures outlined below. 40 Lakh wef 01 st April 2019 and you have registered voluntarily but you do not want to file the return.

Log in to the GST portal. Enter the portal using your Credentials. The GSTN portal is live with the cancellation of GST registration for migratory taxpayers.

Otherwise well send you confirmation within 5 working days that your registration has been cancelled. Provide the reason for cancellation on this page. 5 if the registration of a dealer is cancelled either on his application or under sub-section 7 of section 8 the dealer shall surrender the certificate of registration and the copies thereof if any granted to him to the registering authority within fifteen days from the date of receipt by him of the order cancelling the registration.

Login to the GST Portal with your user-ID and password. Under the services section click on registration and under the registration section select application for revocation of canceled registration option.

Gst Registration Return At Rs 499 Gst Consultancy Services Gst Taxation Consultancy Services Gst Taxation Consultancy Gst Consulting Services Gst Registration Services Gst B M Tax Solution North 24 Parganas Id 20584769412

Step By Step Guide To Apply For Gst Registration

Malaysia Sst Sales And Service Tax A Complete Guide

How To Register For Gst Gst Guide Xero Nz

Registering For Gst Video Guide Youtube

If Place Of Business Is Owned By My Father And Proprietorship Is Owned By Me Then Can I Able To Register For Gst By Uploading Light Bill As Address Proof Of The

Singapore Gst Registration Guide For Foreign Businesses Singaporelegaladvice Com

Everything About Gst Registration Of An Opc Ebizfiling

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Gst Registration Online Gst Registration Process Indiafilings

How To Apply For Gst And Pan For A Partnership Firm Ebizfiling

Step By Step Guide To Apply For Gst Registration

Malaysia Sst Sales And Service Tax A Complete Guide

Step By Step Guide To Apply For Gst Registration

Tn Gst Dept Issued Instructions For Identification And Prevention Of Bill Traders In Newly Applied Registrations A2z Taxcorp Llp

Step By Step Guide To Apply For Gst Registration

Procedure For Registration Of Gst Ipleaders

Step By Step Guide To Apply For Gst Registration

Cancel Gst Registration Gstin Registration Cancellation Procedure